EXHIBIT 99.2

Published on November 13, 2025

Exhibit 99.2

Hyperion DeFi © 2025 1 HYPD Q3 2025 Earnings Supplement More than just HYPE. NASDAQ: HYPD

Hyperion DeFi © 2025 2 Forward - Looking Statements; Disclaimer Except for historical information, all the statements, expectations and assumptions contained in this presentation are forwar d - l ooking statements. Forward - looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strat egies, predictions or any other statements, our future activities or other future events or conditions, including the estimated market opportunities fo r o ur platform technology, the viability of, and risks associated with, our cryptocurrency treasury strategy, and the growth and revenue potential of th e Hyperliquid ecosystem and the growth prospects of Hyperion DeFi, Inc. (“Hyperion DeFi”, “Hyperion” or the “Company”) (NASDAQ:HYPD). These statement s a re based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These s tat ements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, a ctu al outcomes and results may, and in some cases are likely to, differ materially from what is expressed or forecasted in the forward - looking stat ements due to numerous factors discussed from time to time in documents which we file with the U.S. Securities and Exchange Commission (the “SEC”), inc luding in particular, the risks of our cryptocurrency strategy as detailed in our reports filed with the SEC . Any forward - looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, Hyperion DeFi does not undertake any obligation to update any forward - looking statements. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third - party sources and Hyperion DeFi’s own internal estimates and research. While Hyperion DeFi believes these third - party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not i ndependently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sou rces. In addition, no independent source has evaluated the reasonableness or accuracy of Hyperion DeFi’s internal estimates or research and no r eli ance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research. Yo u should conduct your own investigation and analysis of Hyperion DeFi, its business, prospects, results of operations and financial condition. In furnishing this information, Hyperion DeFi does not undertake any obligation to provide you with access to any additional information (includ ing forward - looking information and any projections contained herein) or to update or correct the information. All figures in this deck are not audited.

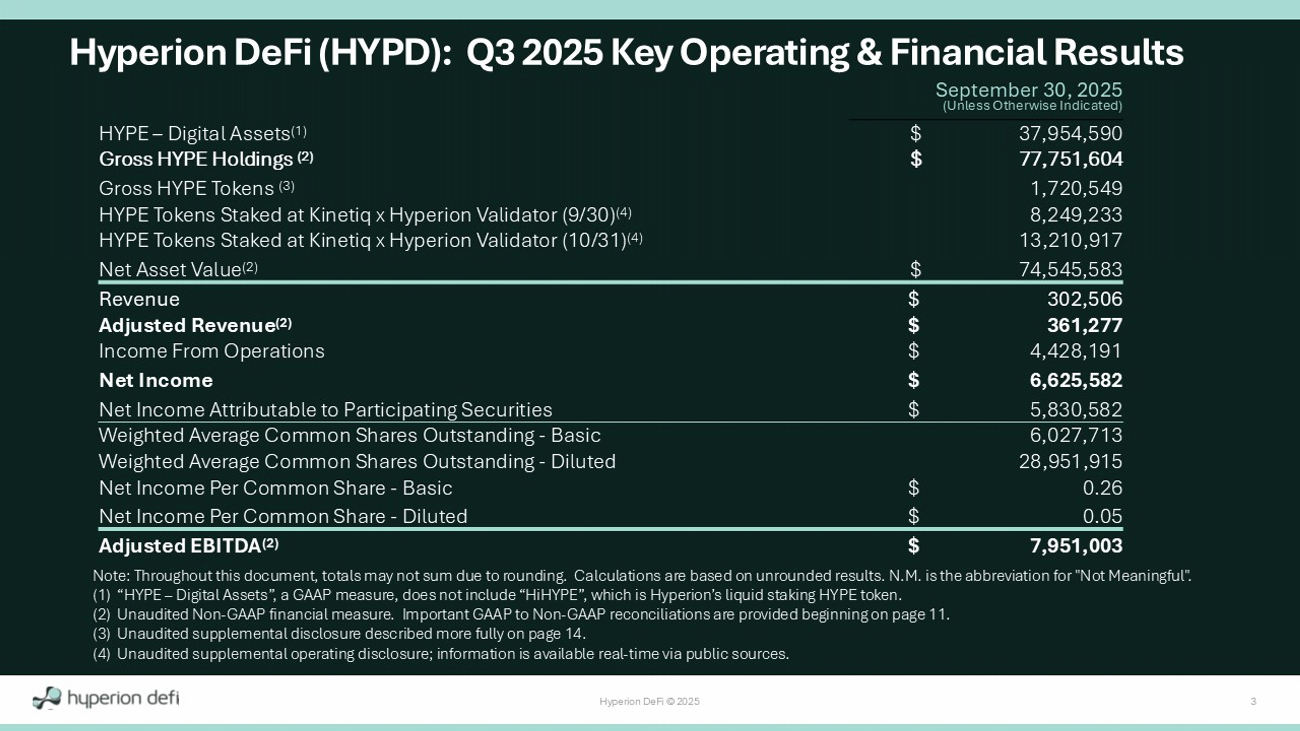

Hyperion DeFi © 2025 3 September 30, 2025 (Unless Otherwise Indicated) $ 37,954,590 HYPE – Digital Assets (1) $ 77,751,604 Gross HYPE Holdings (2) 1,720,549 Gross HYPE Tokens (3) 8,249,233 HYPE Tokens Staked at Kinetiq x Hyperion Validator (9/30) (4) 13,210,917 HYPE Tokens Staked at Kinetiq x Hyperion Validator (10/31) (4) $ 74,545,583 Net Asset Value (2) $ 302,506 Revenue $ 361,277 Adjusted Revenue (2) $ 4,428,191 Income From Operations $ 6,625,582 Net Income $ 5,830,582 Net Income Attributable to Participating Securities 6,027,713 Weighted Average Common Shares Outstanding - Basic 28,951,915 Weighted Average Common Shares Outstanding - Diluted $ 0.26 Net Income Per Common Share - Basic $ 0.05 Net Income Per Common Share - Diluted $ 7,951,003 Adjusted EBITDA (2) Hyperion DeFi (HYPD): Q3 2025 Key Operating & Financial Results Note: Throughout this document, totals may not sum due to rounding. Calculations are based on unrounded results. N.M. is the ab breviation for "Not Meaningful". (1) “HYPE – Digital Assets”, a GAAP measure, does not include “ HiHYPE ”, which is Hyperion’s liquid staking HYPE token. (2) Unaudited Non - GAAP financial measure. Important GAAP to Non - GAAP reconciliations are provided beginning on page 11. (3) Unaudited supplemental disclosure described more fully on page 14. (4) Unaudited supplemental operating disclosure; information is available real - time via public sources.

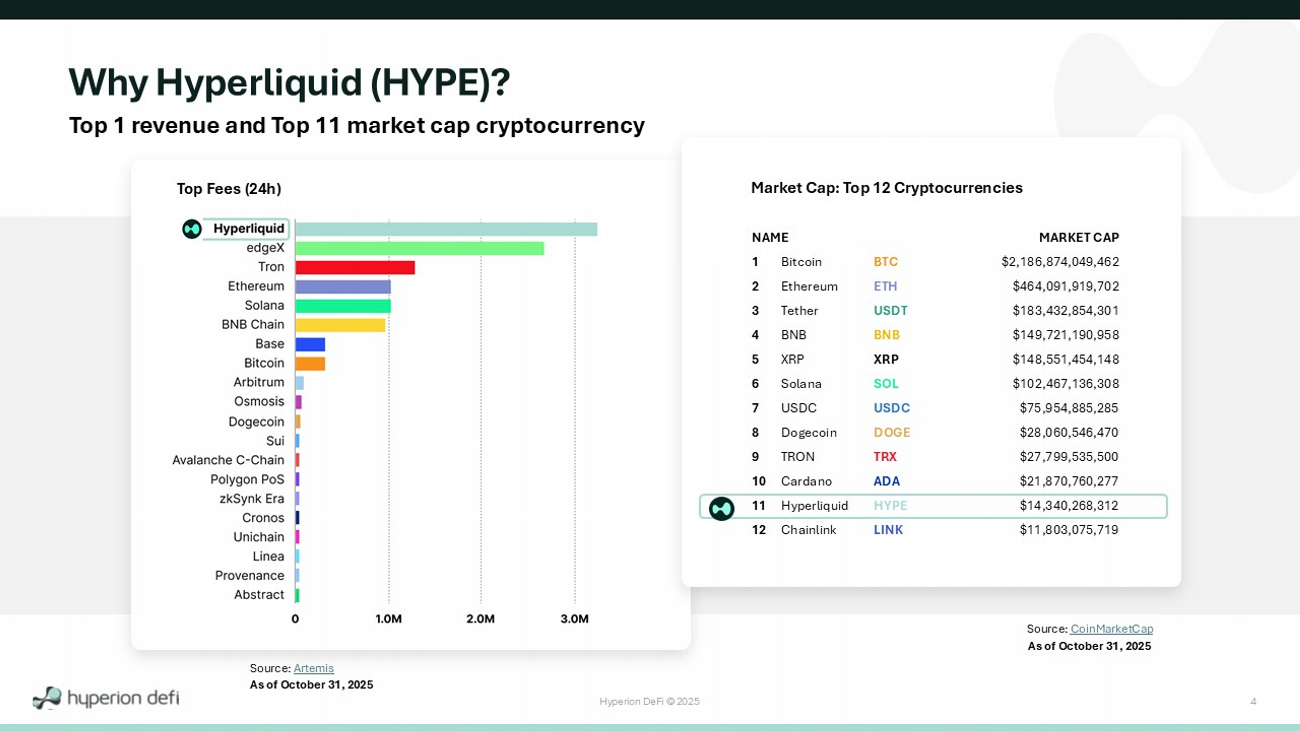

Hyperion DeFi © 2025 4 Why Hyperliquid (HYPE)? Top 1 revenue and Top 11 market cap cryptocurrency Source: CoinMarketCap Source: Artemis As of October 31, 2025 Top Fees (24h) NAME 1 Bitcoin BTC 2 Ethereum ETH 3 Tether USDT 4 BNB BNB 5 XRP XRP 6 Solana SOL 7 USDC USDC 8 Dogecoin DOGE 9 TRON TRX 10 Cardano ADA 11 Hyperliquid HYPE 12 Chainlink LINK MARKET CAP $2,186,874,049,462 $464,091,919,702 $183,432,854,301 $149,721,190,958 $148,551,454,148 $102,467,136,308 $75,954,885,285 $28,060,546,470 $27,799,535,500 $21,870,760,277 $14,340,268,312 $11,803,075,719 Market Cap: Top 12 Cryptocurrencies As of October 31, 2025

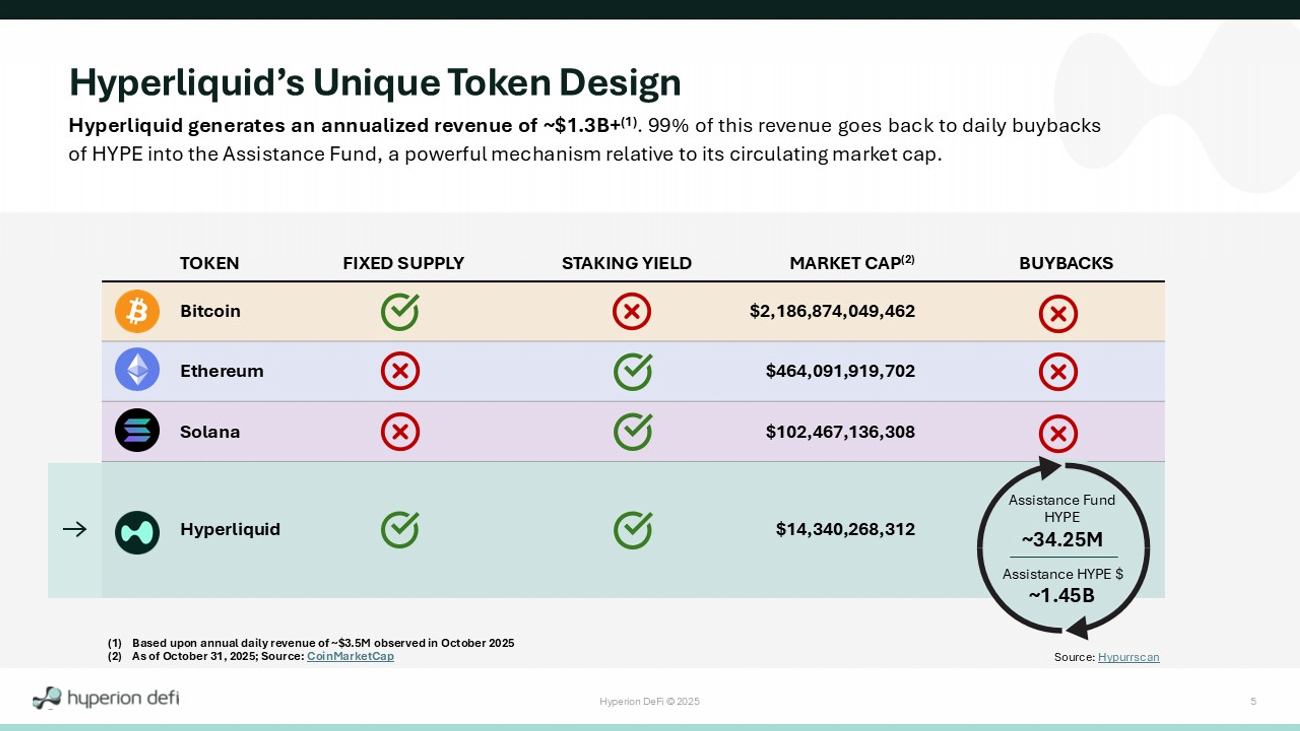

Hyperion DeFi © 2025 5 BUYBACKS MARKET CAP (2) STAKING YIELD FIXED SUPPLY TOKEN $2,186,874,049,462 Bitcoin $464,091,919,702 Ethereum $102,467,136,308 Solana $14,340,268,312 Hyperliquid Hyperliquid’s Unique Token Design Hyperliquid generates an annualized revenue of ~ $ 1 . 3 B+ ( 1 ) . 99 % of this revenue goes back to daily buybacks of HYPE into the Assistance Fund, a powerful mechanism relative to its circulating market cap . Assistance Fund HYPE ~34.25M Assistance HYPE $ ~1.45B Source: Hypurrscan (1) Based upon annual daily revenue of ~$3.5M observed in October 2025 (2) As of October 31, 2025; Source: CoinMarketCap

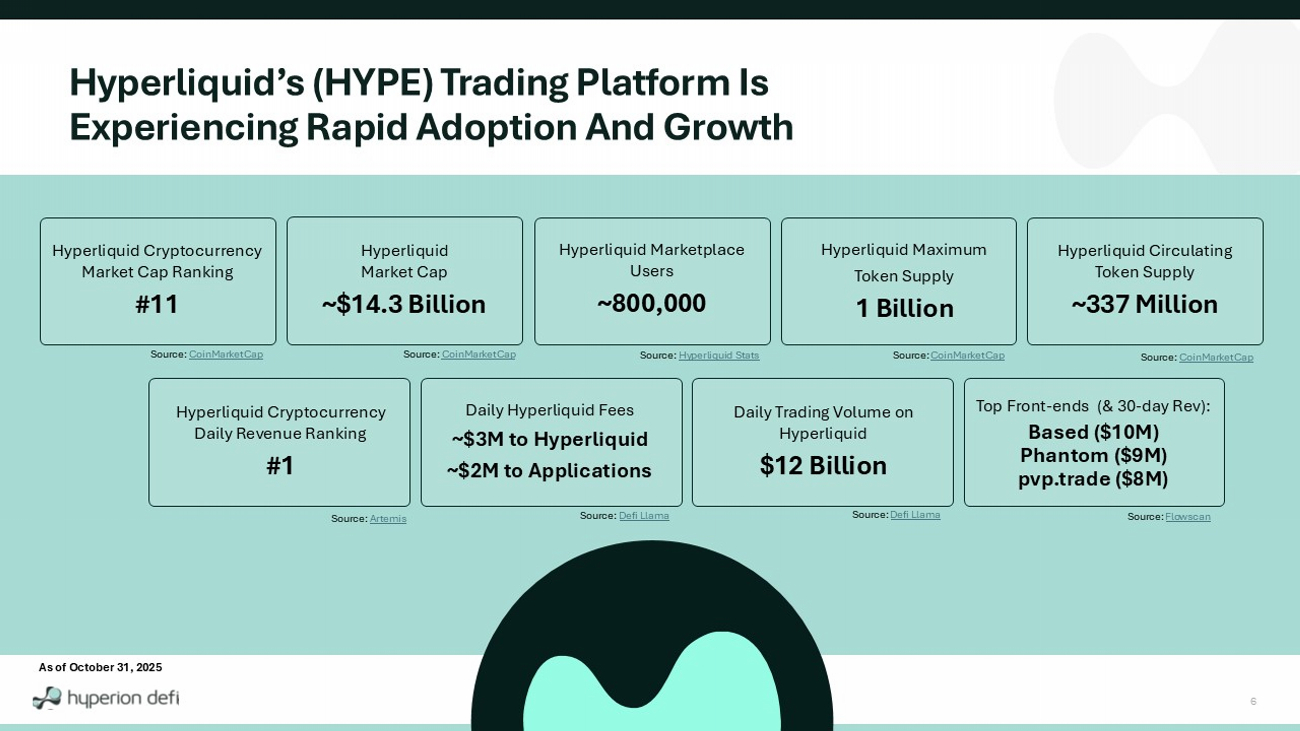

Hyperion DeFi © 2025 6 Hyperliquid’s (HYPE) Trading Platform Is Experiencing Rapid Adoption And Growth Hyperliquid Cryptocurrency Market Cap Ranking #11 Hyperliquid Market Cap ~$14.3 Billion Daily Trading Volume on Hyperliquid $12 Billion Hyperliquid Circulating Token Supply ~337 Million Daily Hyperliquid Fees ~$3M to Hyperliquid ~$2M to Applications Hyperliquid Marketplace Users ~800,000 Hyperliquid Maximum Token Supply 1 Billion Top Front - ends (& 30 - day Rev): Based ($10M) Phantom ($9M) pvp.trade ($8M) Hyperliquid Cryptocurrency Daily Revenue Ranking #1 Source: Flowscan Source: Hyperliquid Stats Source: Defi Llama Source: Defi Llama Source: CoinMarketCap Source: CoinMarketCap Source: CoinMarketCap Source: CoinMarketCap Source: Artemis As of October 31, 2025

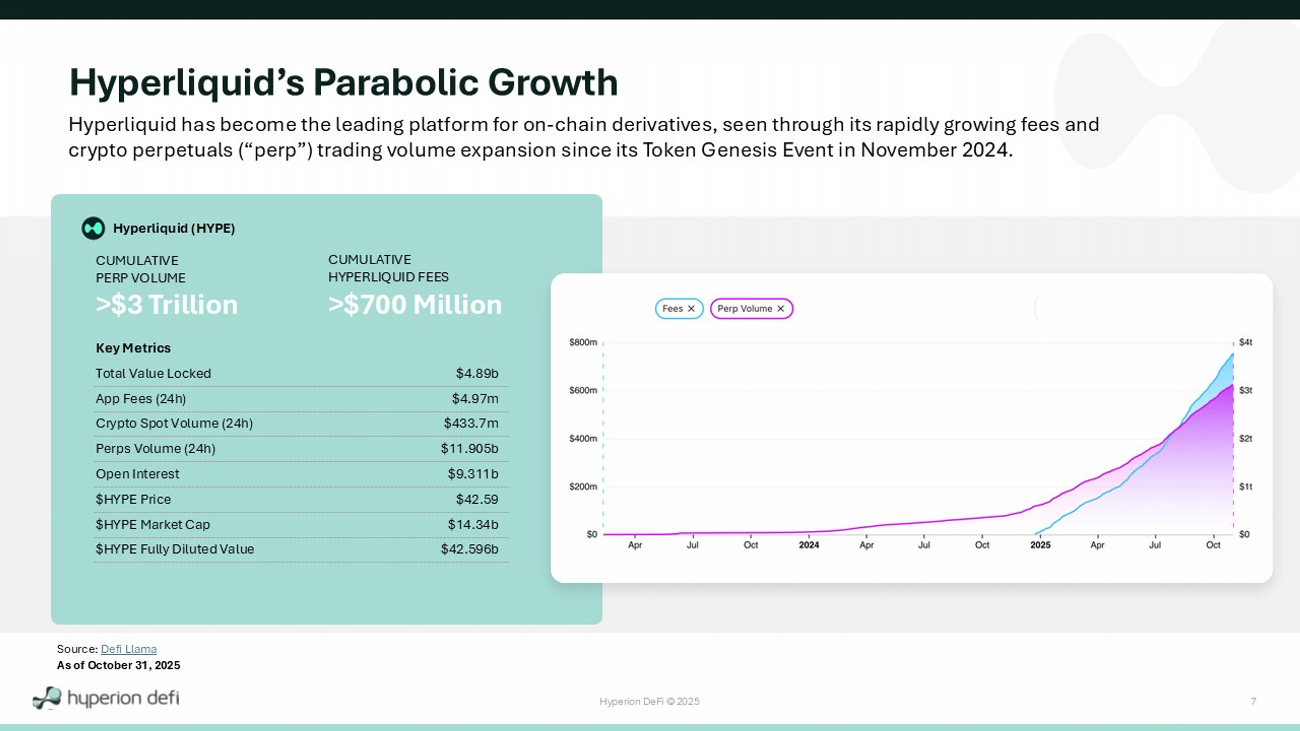

Hyperion DeFi © 2025 7 Hyperliquid’s Parabolic Growth Hyperliquid has become the leading platform for on - chain derivatives, seen through its rapidly growing fees and crypto perpetuals (“perp”) trading volume expansion since its Token Genesis Event in November 2024. Source: Defi Llama Key Metrics Total Value Locked App Fees (24h) Crypto Spot Volume (24h) Perps Volume (24h) Open Interest $HYPE Price $HYPE Market Cap $HYPE Fully Diluted Value $4.89b $4.97m $433.7m $11.905b $9.311b $42.59 $14.34b $42.596b >$ 3 Trillion CUMULATIVE PERP VOLUME Hyperliquid (HYPE) As of October 31, 2025 >$ 700 Million CUMULATIVE HYPERLIQUID FEES

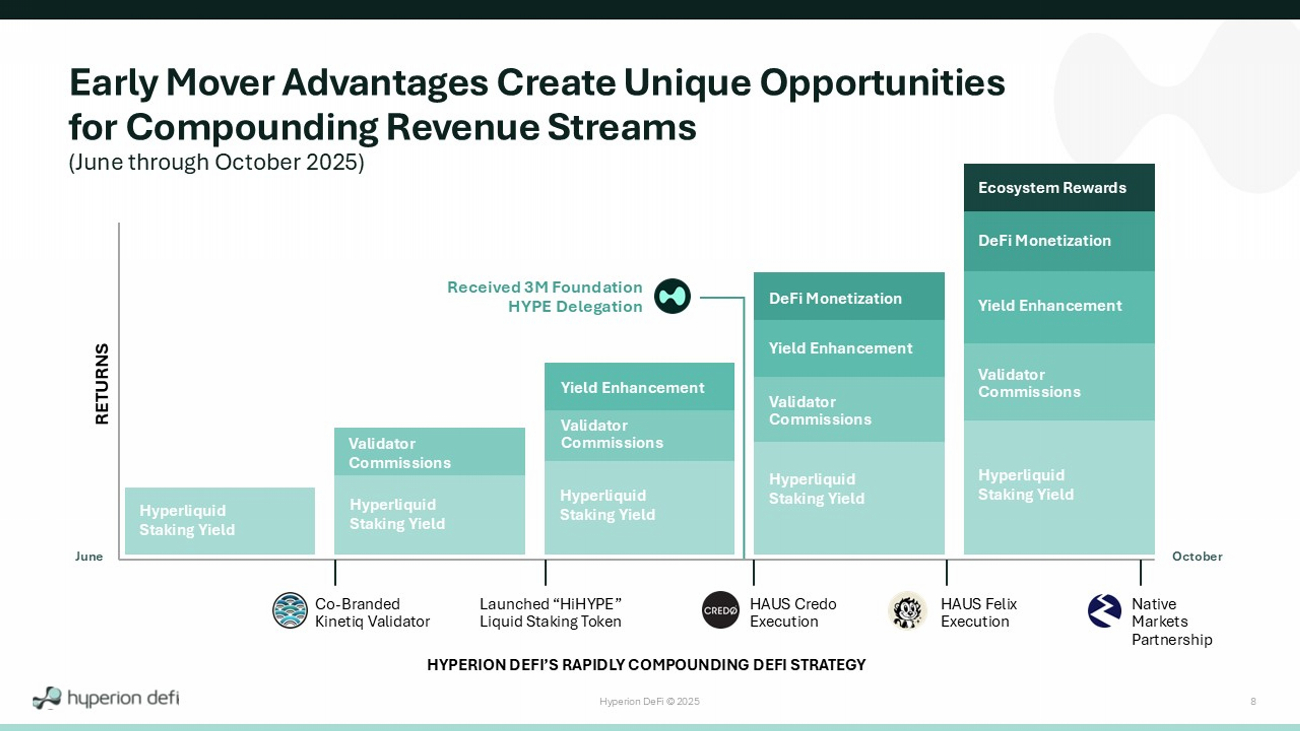

Hyperion DeFi © 2025 8 Early Mover Advantages Create Unique Opportunities for Compounding Revenue Streams (June through October 2025) Hyperliquid Staking Yield Validator Commissions Hyperliquid Staking Yield Hyperliquid Staking Yield Validator Commissions Yield Enhancement Validator Commissions Yield Enhancement Hyperliquid Staking Yield DeFi Monetization Validator Commissions Yield Enhancement Hyperliquid Staking Yield DeFi Monetization Ecosystem Rewards HAUS Credo Execution HAUS Felix Execution Co - Branded Kinetiq Validator RETURNS HYPERION DEFI’S RAPIDLY COMPOUNDING DEFI STRATEGY Launched “ HiHYPE ” Liquid Staking Token Received 3M Foundation HYPE Delegation June October Native Markets Partnership

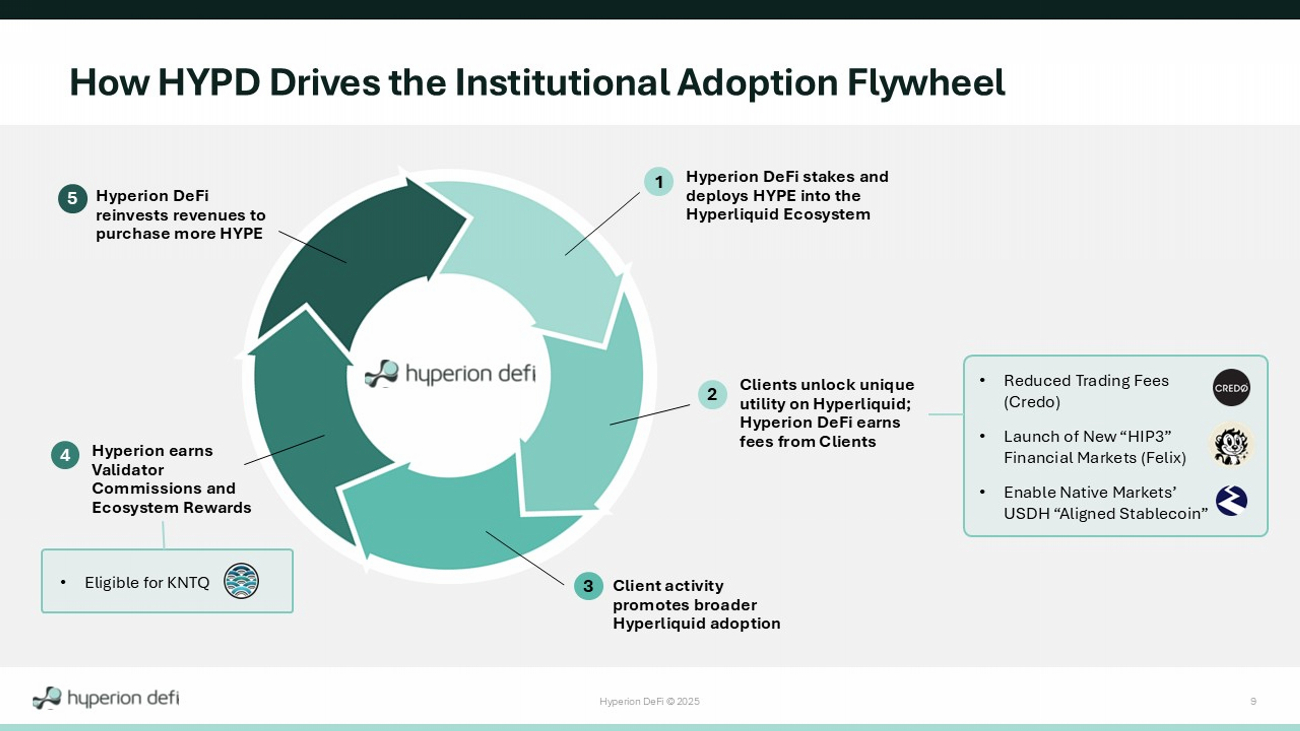

Hyperion DeFi © 2025 9 Hyperion DeFi stakes and deploys HYPE into the Hyperliquid Ecosystem Clients unlock unique utility on Hyperliquid ; Hyperion DeFi earns fees from Clients Client activity promotes broader Hyperliquid adoption Hyperion earns Validator Commissions and Ecosystem Rewards Hyperion DeFi reinvests revenues to purchase more HYPE How HYPD Drives the Institutional Adoption Flywheel • Reduced Trading Fees (Credo) • Launch of New “HIP3” Financial Markets (Felix) • Enable Native Markets’ USDH “Aligned Stablecoin” 1 2 3 4 5 • Eligible for KNTQ

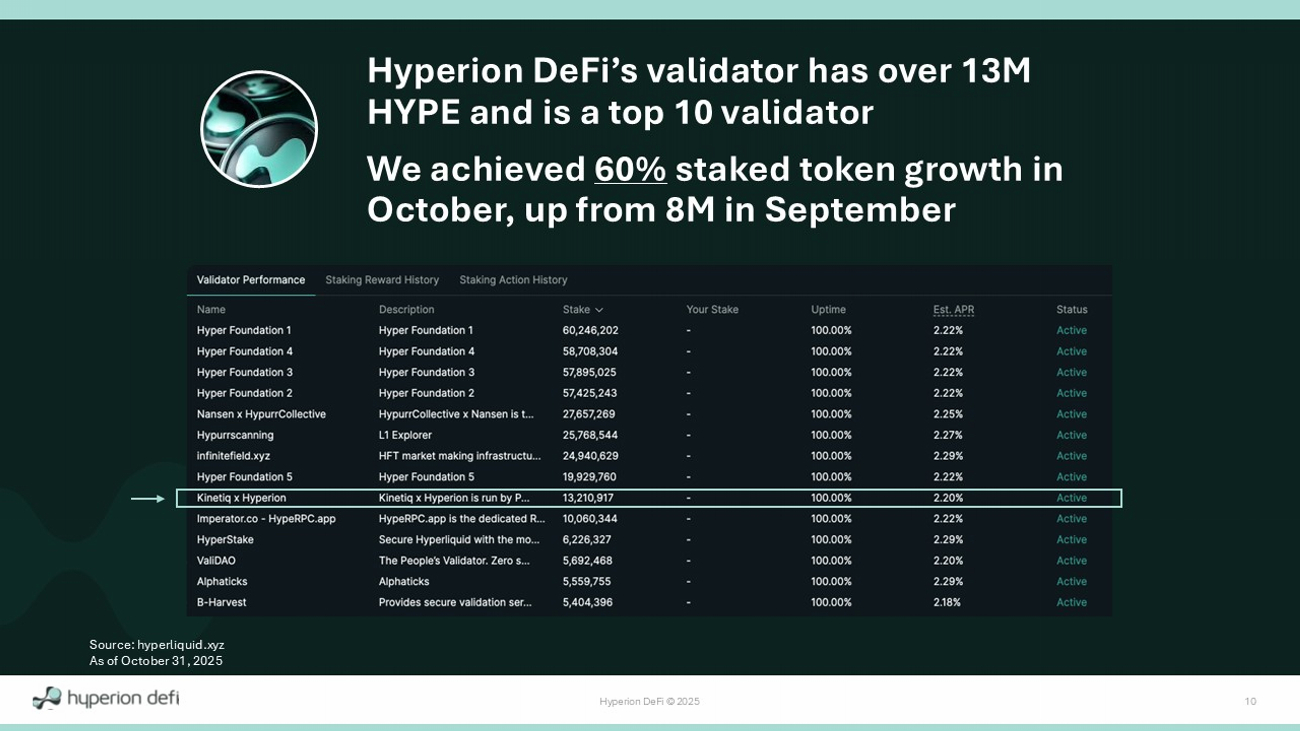

Hyperion DeFi © 2025 10 Hyperion DeFi’s validator has over 13M HYPE and is a top 10 validator We achieved 60% staked token growth in October, up from 8M in September As of October 31, 2025 Source: hyperliquid.xyz

Hyperion DeFi © 2025 11 GAAP to Non - GAAP Reconciliation

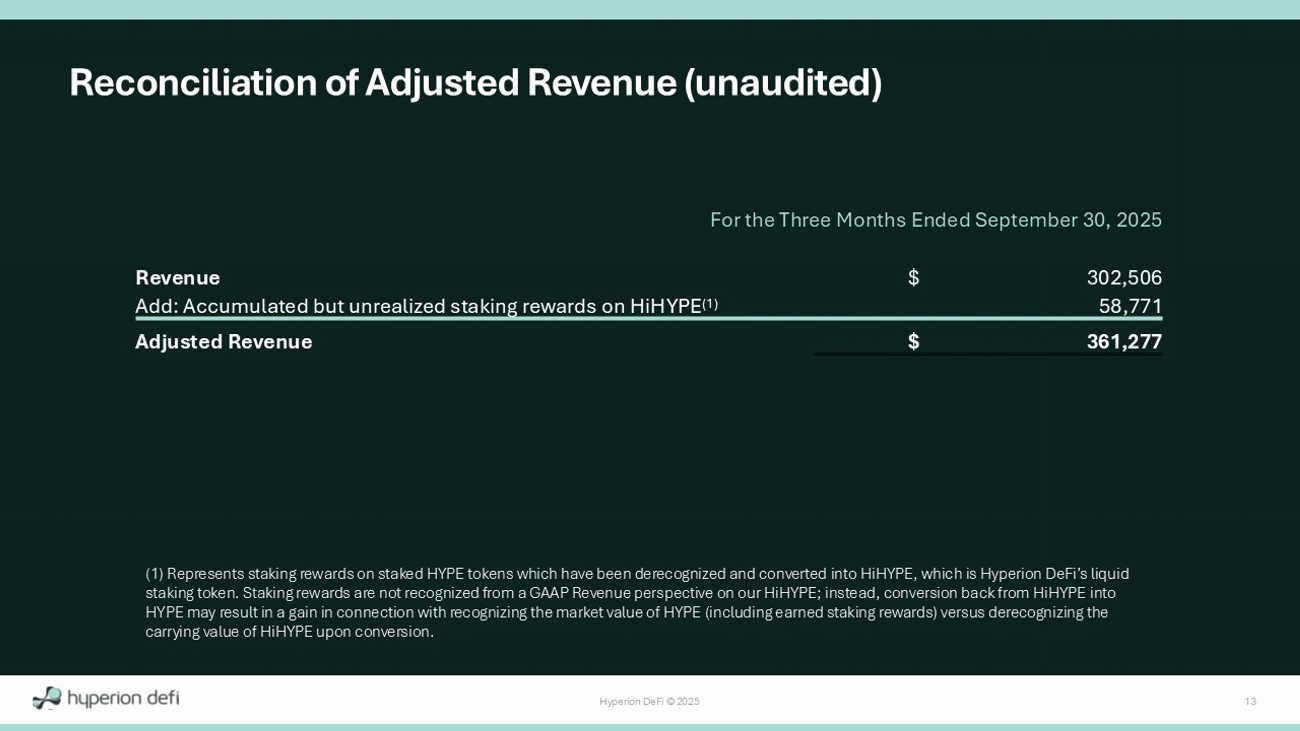

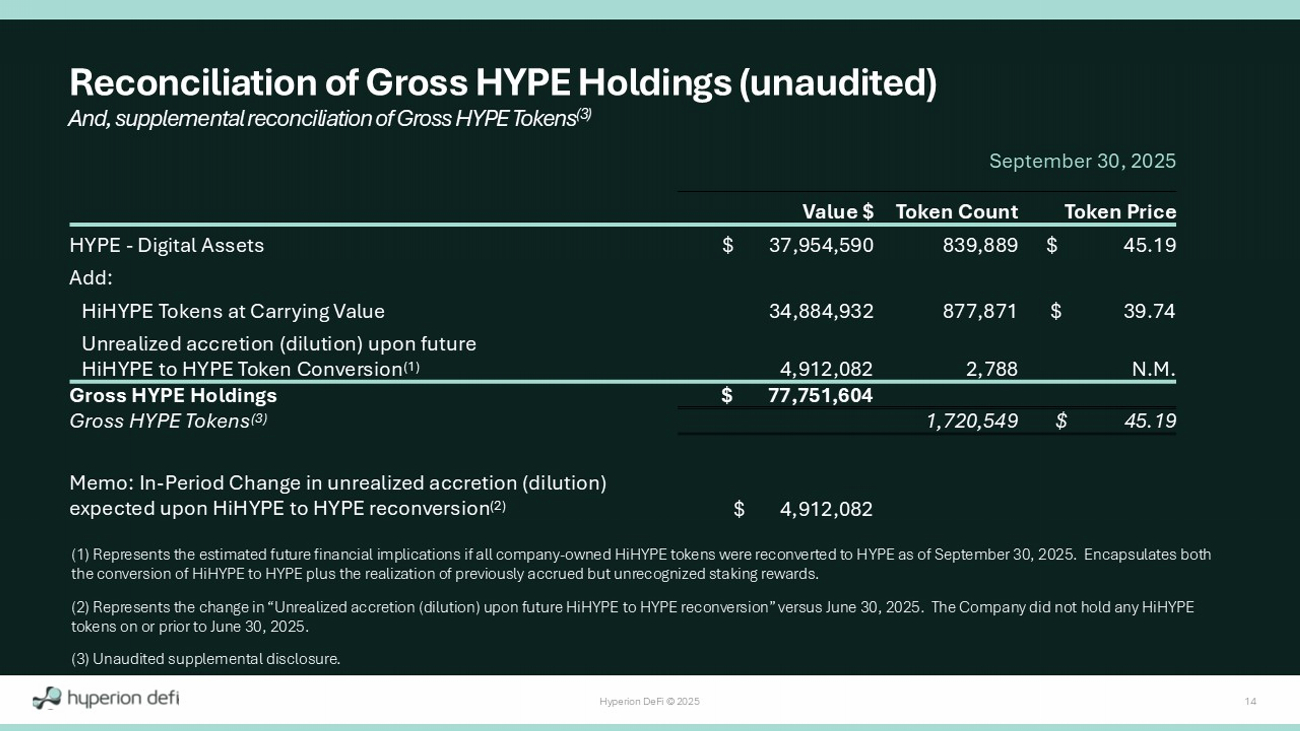

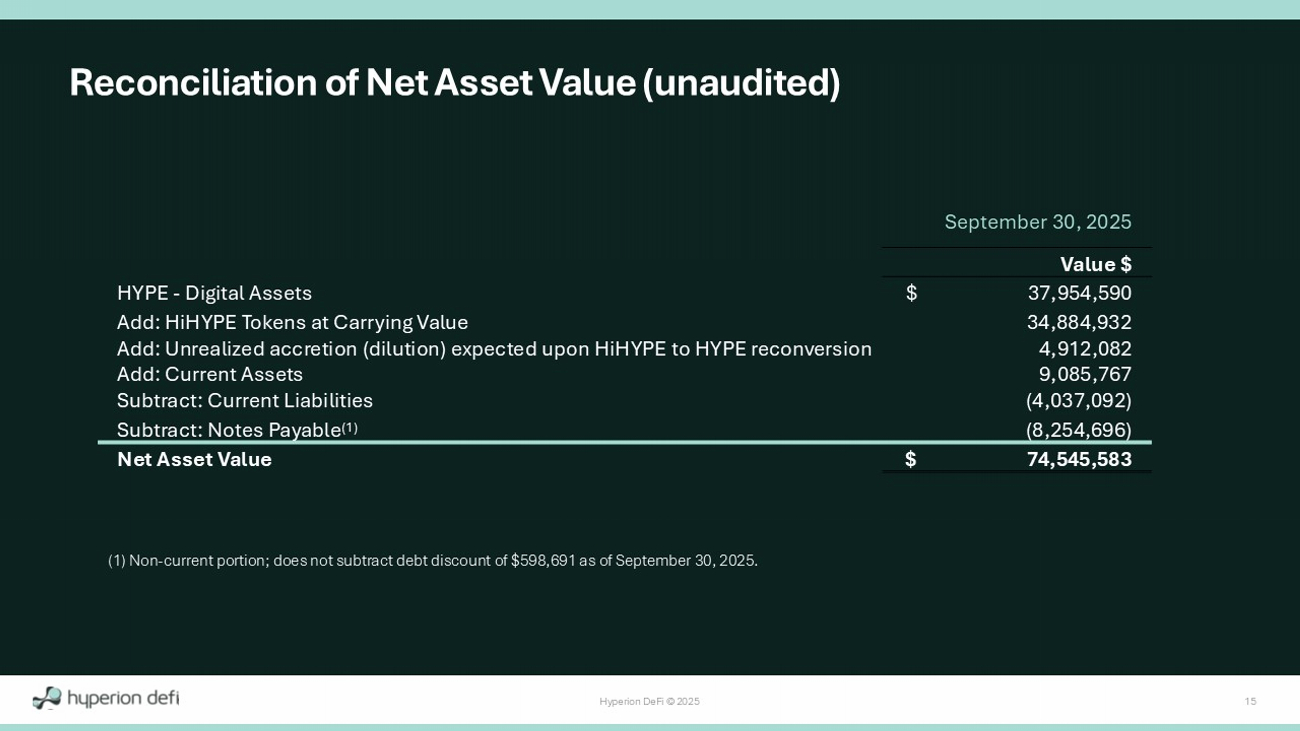

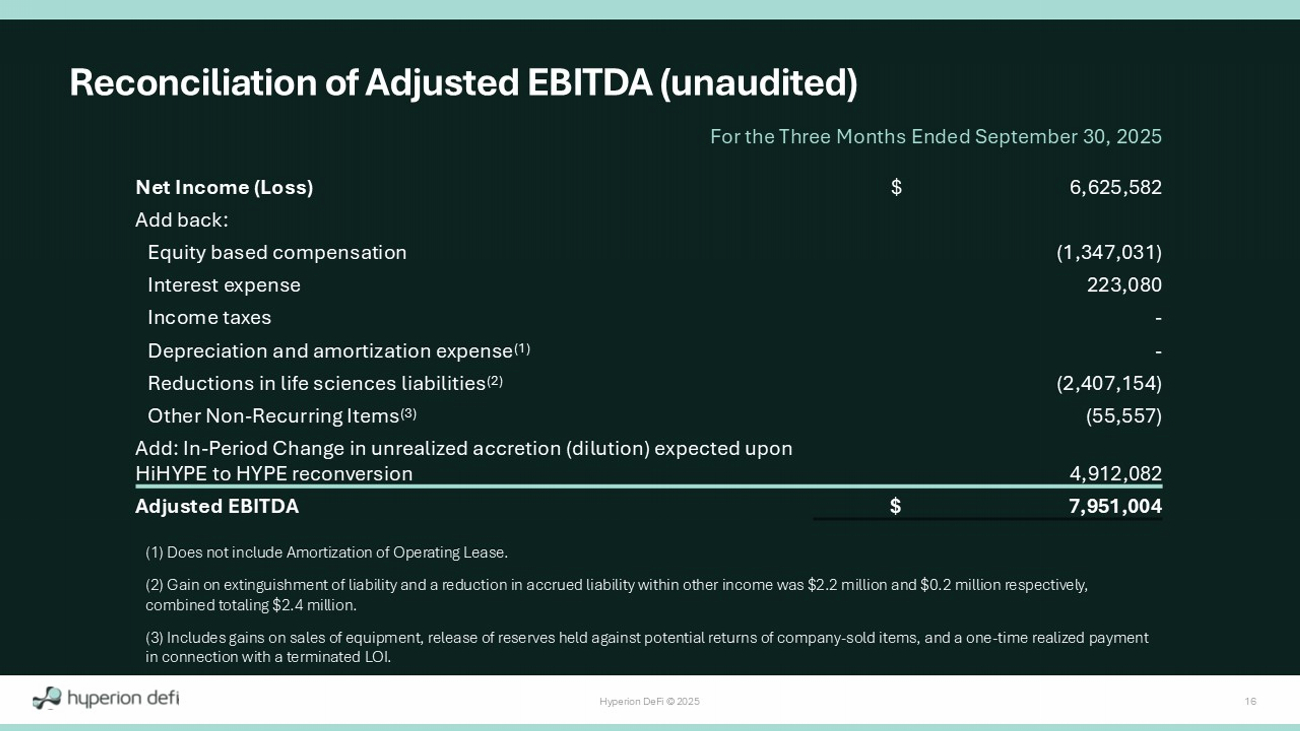

Hyperion DeFi © 2025 12 Non - GAAP Financial Measures In addition to our results determined in accordance with GAAP, this presentation and the accompanying tables contain Adjusted Re venue, Gross HYPE Holdings, Net Asset Value, and Adjusted EBITDA, which are non - GAAP financial measures. Adjusted Revenue, Gross HYPE Holdings, Net Asset Value, and Adjusted EBITDA are unaudited, presented as s upp lemental disclosure, and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Please see page 13 for a reconciliation of Revenue to Adjusted Revenue during the three months ended September 30, 2025. Plea se see page 14 for a reconciliation of HYPE - Digital Assets to Gross HYPE Holdings as of September 30, 2025. Please see page 15 for a reconciliation of HYPE - Digital Assets to Net Asset Value as of September 30, 2025. Please s ee page 16 for a reconciliation of Net Income to Adjusted EBITDA during the three months ended September 30, 2025. It is important to note that the particular items we exclude from, or include in, Adjusted Revenue, Gross HYPE Holdings, Net Ass et Value, and Adjusted EBITDA may differ from the items excluded from, or included in, similar non - GAAP financial measures used by other companies in the same industry. We also periodically review our non - GAAP financial measure s and may revise these measures to reflect changes in our business or otherwise. “Adjusted Revenue” reflects all staking, commissions, and gross operational, asset - generating business activity in - period. It is reconciled to the GAAP measure “Revenue” by adding accumulated but unrealized rewards on HiHYPE . Staking rewards are not recognized from a GAAP Revenue perspective on our liquid staking token; instead, conversion back fr om HiHYPE into HYPE may result in a gain in connection with recognizing the market value of HYPE (including earned staking rewards) versus derecognizing the carrying value of HiHYPE upon conversion. We believe Adjusted Revenue provides a more complete view of our staking activities and overall recurring bu si ness profile, without potential period - to - period variability due to HiHYPE liquid staking activities. As such, Adjusted Revenue is an important metric used by our management for financial, risk manage me nt and operational decision - making, and provides an additional tool for investors to use to understand and compare our operating results across accountin g p eriods. “Gross HYPE Holdings” is the gross market value of the Company’s HYPE assuming all HiHYPE tokens were converted back to HYPE tokens as of September 30, 2025. It is reconciled to the GAAP measure “HYPE - Digital Assets ” by adding ( i ) HiHYPE Tokens at carrying value and (ii) the unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion as of September 30, 2025. We believe Gross HYPE Holdings is a helpful non - GAAP financial measure to our management and investors because it eliminates the temporary financial impacts caused by the conversion of HYP E t okens into HiHYPE tokens, which (a) derecognizes staking rewards and commissions on our HiHYPE tokens and (b) does not recognize upward mark - to - market movements in underlying HYPE tokens given HiHYPE is carried at the lower of cost basis or impaired value. As such, it provides useful information about our balance sheet, allows for greater transparency with respect to important metrics used by our management for financial, risk m ana gement and operational decision - making, and provides an additional tool for investors to use to understand and compare our operating results across accounting periods. “Net Asset Value” is the market value of our marketable digital assets less net outstanding debt. It is reconciled to the GAA P m easure “HYPE - Digital Assets” by ( i ) adding HiHYPE Tokens at carrying value, (ii) adding the unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion, (iii) adding Current Assets, (iv) subtracting Current Liabilities, and (v) subtracting Notes Payable (N on - current portion, without subtracting corresponding debt discounts or any unamortized issuance expenses). We believe Net Asset Value is a helpful non - GAAP financial measure to our manag ement and investors because it provides a more complete picture of our net liquid and marketable assets. It does not include Other Digital Assets which may not be immediately marketable. It does not include othe r n on - current assets or non - current liabilities beyond the aforementioned items. The Company believes “Net Asset Value provides useful information about our balance sheet and financial performance, enhances the overall understa ndi ng of our past performance and future prospects, allows for greater transparency with respect to important metrics used by our management for financial, risk management and operational decision - making, and provides an additio nal tool for investors to use to understand and compare our operating results across accounting periods. “Adjusted EBITDA” is a financial earnings measure meant to reflect management’s view of recurring business activities and a m ore comparable view of the mark - to - market impacts on our digital asset treasury holdings in - period. It is reconciled to the GAAP measure “Net Income (Loss)” by removing ( i ) equity based compensation, (ii) interest expense, (iii) income taxes, (iv) depreciation and amortization expense (excluding am ortization of operating lease), (v) non - recurring gains from reductions in life sciences liabilities, and (vi) other non - recurring items which we do not consider ma terial in nature; and, it adds the in - period change in unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion. The items excluded from our Adjusted EBITDA are excluded because they are non - cash in nature, or because the amount and timing of these items are unpredictable, are not driven by core results of operations, and render comparisons with prior periods and competitors less meaningful. We add to Adjusted EBITDA the in - period c hange in unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion to give a more complete picture of mark - to - market impacts on our HYPE holdings, disregarding the temporary conversion of HYPE to HiHYPE . Adjusted EBITDA is used by management, in addition to GAAP financial measures, to understand and compare our operating results across accounting periods, for risk management and operational decision - making purposes. This non - GAAP measure provides investors with additional information in evaluating the Company's operating performance. Investors are cautioned that there are material limitations associated with the use of non - GAAP financial measures as an analyti cal tool.

Hyperion DeFi © 2025 13 Reconciliation of Adjusted Revenue (unaudited) (1) Represents staking rewards on staked HYPE tokens which have been derecognized and converted into HiHYPE , which is Hyperion DeFi’s liquid staking token. Staking rewards are not recognized from a GAAP Revenue perspective on our HiHYPE ; instead, conversion back from HiHYPE into HYPE may result in a gain in connection with recognizing the market value of HYPE (including earned staking rewards) versus d ere cognizing the carrying value of HiHYPE upon conversion. For the Three Months Ended September 30, 2025 $ 302,506 Revenue 58,771 Add: Accumulated but unrealized staking rewards on HiHYPE (1) $ 361,277 Adjusted Revenue

Hyperion DeFi © 2025 14 September 30, 2025 Token Price Token Count Value $ $ 45.19 839,889 $ 37,954,590 HYPE - Digital Assets Add: $ 39.74 877,871 34,884,932 HiHYPE Tokens at Carrying Value N.M. 2,788 4,912,082 Unrealized accretion (dilution) upon future HiHYPE to HYPE Token Conversion (1) $ 77,751,604 Gross HYPE Holdings $ 45.19 1,720,549 Gross HYPE Tokens (3) $ 4,912,082 Memo: In - Period Change in unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion (2) (1) Represents the estimated future financial implications if all company - owned HiHYPE tokens were reconverted to HYPE as of September 30, 2025. Encapsulates both the conversion of HiHYPE to HYPE plus the realization of previously accrued but unrecognized staking rewards. (2) Represents the change in “Unrealized accretion (dilution) upon future HiHYPE to HYPE reconversion” versus June 30, 2025. The Company did not hold any HiHYPE tokens on or prior to June 30, 2025. (3) Unaudited supplemental disclosure. Reconciliation of Gross HYPE Holdings (unaudited) And, supplemental reconciliation of Gross HYPE Tokens (3)

Hyperion DeFi © 2025 15 September 30, 2025 Value $ $ 37,954,590 HYPE - Digital Assets 34,884,932 Add: HiHYPE Tokens at Carrying Value 4,912,082 Add: Unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion 9,085,767 Add: Current Assets (4,037,092) Subtract: Current Liabilities (8,254,696) Subtract: Notes Payable (1) $ 74,545,583 Net Asset Value (1) Non - current portion; does not subtract debt discount of $598,691 as of September 30, 2025. Reconciliation of Net Asset Value (unaudited)

Hyperion DeFi © 2025 16 (1) Does not include Amortization of Operating Lease. (2) Gain on extinguishment of liability and a reduction in accrued liability within other income was $2.2 million and $0.2 mi lli on respectively, combined totaling $2.4 million. (3) Includes gains on sales of equipment, release of reserves held against potential returns of company - sold items, and a one - ti me realized payment in connection with a terminated LOI. For the Three Months Ended September 30, 2025 $ 6,625,582 Net Income (Loss) Add back: (1,347,031) Equity based compensation 223,080 Interest expense - Income taxes - Depreciation and amortization expense (1) (2,407,154) Reductions in life sciences liabilities (2) (55,557) Other Non - Recurring Items (3) 4,912,082 Add: In - Period Change in unrealized accretion (dilution) expected upon HiHYPE to HYPE reconversion $ 7,951,004 Adjusted EBITDA Reconciliation of Adjusted EBITDA (unaudited)

Hyperion DeFi © 2025 17 Frictionless exposure to Hyperliquid’s native token HYPE. Access next - generation Decentralized Finance (DeFi). Bridging public markets and on - chain strategies. More than just HYPE. NASDAQ: HYPD